.

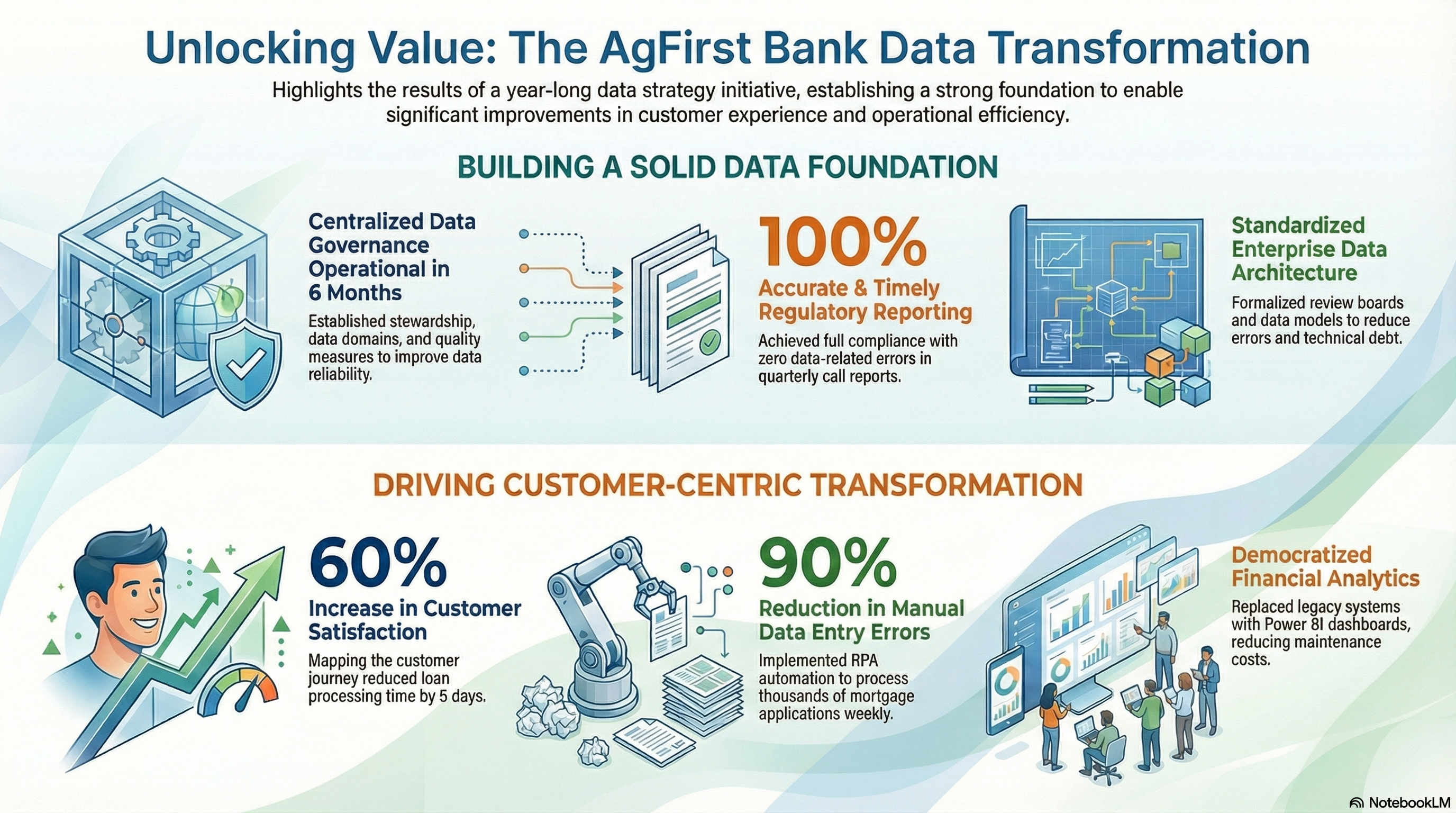

Introduced enterprise data strategy, architecture & governance to evolve from a warehouse-only data environment. Additionally, formulated customer data strategy collaborating with the CX-2020 committee and redefined customer-centricity.

.

Enterprise Data Governance:

* Office of Data Management: Operationalized centralized data governance in 6 months, with Stewardship, data domains, critical data elements, data quality measures, and data policies & standards for the southeastern district, improving data reliability to leverage as assets by its 21 associate banks for a differentiating customer experience.

* Quarterly Call Reports: Stood up a new regulatory domain achieving 100% timely and accurate generation of quarterly call reports with governed data, ensuring full regulatory compliance.

.

Enterprise Data Architecture, Enablement, and Usage:

* Data Domain Enablement: Identified and standardized 12 key enterprise data domains with a common business taxonomy and data models for governance and stewardship. Procured Erwin data modeling tool and formalized the development to production promotion process with relevant approvals, leading to adherence of foundational data architecture.

* Architecture Governance: Formalized Architecture Review Board with respective intake and approval processes to govern technology solutions ensuing compliance with standards, minimizing technical debt, improving data architecture consistency and reducing deployment errors.

* Customer Master: Implemented Customer Master Data Registry to maintain a unique ID in lieu of multiple customer intake points like mortgage originating application systems. Provisioned master data as products to serve down-stream applications with timely, accurate, integral, and fit-for-purpose data increasing overall operational efficiency.

* Hyperion Financial Cube Replacement: Relevant dimensional data marts and Power BI dashboards are built to reduce maintenance costs and technical debt, and democratize financial analytics with drill-down dashboard capabilities.

.

Customer-Centric Transformation:

* Automation (RPA): Implemented Automation Anywhere to automate data ingestion from mortgage application systems, processing thousands of records weekly, resulting in reduction of manual data entry errors by over 90%, and acceleration of the loan origination process.

* Customer Data Strategy: Architected the core data strategy for the bank’s CX-2020 initiative, defining the MDM and analytics roadmap to achieve targeted improvements in dynamic customer segmentation, churn analysis, and lifetime value.

* Customer Experience Management: Identified and mapped 12+ customer touch-points in the loan origination journey, providing the blueprint to reduce processing time by 5 days, streamline operations, and measurably increase customer satisfaction.

.